Article AZ 2023 Tax Credits

2023 ARIZONA TAX CREDITS

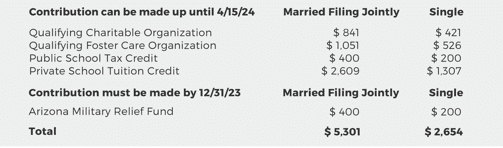

The total tax credits available for 2023 are as follows. Most of these can now be made up until April 15, 2024 for the 2023 tax return. If you make your donation in 2024, specify to the organization which year you want the donation applied to 2023 or 2024.

The Az Military Relief Fund may reach their maximum contributions before year end so always check with them or their website before making the contribution if you want to receive a tax credit.

Arizona Tax Credits

Taking tax credits allows you to direct the amount of tax you are paying to specific causes. If you make the contribution, it is a direct reduction of the amount of state of Arizona tax owed. Due to changes in federal IRS tax laws, in most cases the contribution will not be allowed for federal taxes. You pay the same amount in total, but you pay part of it (tax credits) to organizations you choose rather than to the state of Arizona in income taxes. You need to have an Arizona tax liability to claim the tax credit.

Information and list of qualifying organizations can be found at https://azdor.gov/tax-credits

- QUALIFYING 501(C)(3) CHARITABLE ORGANIZATION

$841 for married filing joint return; $421 for single. The charities must be certified by the state of AZ to qualify. The qualifying charitable organizations spend at least 50% of their budget on services to Arizona residents under defined income levels. The link below is a list of all charities and umbrella organizations certified by the state of Arizona. Donations to certain Umbrella agencies such as United Way also qualify if you specify the funds should go to a tax credit organization.

https://azdor.gov/sites/default/files/media/CREDITS_2023_qco.pdf

- QUALIFYING FOSTER CARE CHARITABLE ORGANIZATIONS

$1,051 for married filing joint returns; $526 for single. This credit is for organizations that are Qualifying Foster Care Organizations providing ongoing services to at least 200 foster children in Arizona and spending at least 50% of its budget for care of foster children. This is in addition to the tax credit for charitable organizations. You can give a total of $1,892 for married filing joint return or $947 for single (by combining the qualifying charitable organization tax credit and foster care credit) to the same organization or you can split up the two and give the separate limits to two different organizations. Donations to certain Umbrella agencies such as United Way also qualify if you specify the funds should go to a tax credit organization. The link below is a list of charities certified by the state of Arizona that meet both requirements:

https://azdor.gov/sites/default/files/media/CREDITS_2023_qfco.pdf

- PUBLIC SCHOOL TAX CREDIT (THIS INCLUDES CHARTER SCHOOLS) A contribution to a public school for support of extra-curricular activities, character education programs, or CPR Training – $400 for married filing joint return; $200 for single. Extra-curricular activities are school-sponsored activities that require enrolled students to pay a fee to participate, including band uniforms, equipment or uniforms for varsity athletic activities, or scientific laboratory materials. This does not include out of state trips that are solely for competitive events, senior trips, or events that are recreational, amusement or tourist alternatives. You can donate even if you have a child participating in the activity. Contributions to a school PTO or PTA do not qualify. A list of schools can be found at:

https://azdor.gov/sites/default/files/media/PUBLICATION ADESchoolListing.pdf

- PRIVATE SCHOOL TUITION TAX CREDIT

Donation to a qualified school tuition organization that provides scholarships to private schools – $1,308 for married filing joint return; $655 for single. You can specify the private school you want scholarship to go to, but you cannot specify a student you want to receive the scholarship. Once you have made the maximum contribution ($1,308 or $655) you can then make an additional contribution of $1,301 for married filing joint or $652 for single (called the switcher credit). The total credit for both types is $2,609 for married filing jointly and $1,307 for filing single. The link below is a list of school tuition organizations certified by the state of Arizona:

https://azdor.gov/sites/default/files/REPORTS_sto-i-list.pdf

- AZ MILITARY RELIEF FUND

$400 for married filing joint return; $200 for single. The Az Military Relief Fund (MFRF) provides support to families of Arizona service members who are currently deployed, have been injured or killed or are facing hardship caused by their deployment. Arizona expanded the MFRF program to include Pre-9/11 applicants who meet all three of the qualifying MFRF criteria. The donor can designate on the form whether their donations go to Pre-9/11 applicants, Post-9/11 applicants, or both. This credit is limited to a total contribution of $1,000,000 for the tax credit each year and they usually reach that limit before year end. This is the only tax credit that must be made by December 31, 2023 for the 2023 tax year. You can make a contribution at the following site:

https://dvs.az.gov/donate/military-family-relief-fund-2023

SANDRA A. TURNER CPA PC

For years, Sandra A. Turner, CPA, PC has been providing quality, personalized financial guidance to local individuals and businesses. With expertise ranging from basic tax management and accounting services to more in-depth services such as audits, financial statements, and financial planning, Sandra A. Turner, CPA, PC is one of the leading firms in and throughout Tempe.

Sandra Turner

CPA

PH: 480.695.7699

EMAIL: sturner@sturnercpa.com WEB: www.sturnercpa.com

WWW.STURNERCPA.COM